jersey city property tax delay

Qualifier Property Location 18 14502 00011 20 HUDSON ST. When the city council adopted the ordinance in March it set the tax at a quarter of a penny per 100 but the council can vote to increase the levy to as much as 2 cents per 100.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

TO VIEW PROPERTY TAX ASSESSMENTS.

. Jersey City Mayor Steve Fulop speaks at a June 16 event in Journal Square. Pay In Person - Walk-in payments can be made at The Tax Collectors office which is open 830 am. Property Taxes are delayed.

The city administration contends it cut taxes by 960 last year to offset the 1000 school tax hike in 2021 and the 2022 spending plan is more in line with the 2020 budget. Rough figures from the ANCHOR program. JERSEY CITY -- Third-quarter tax bills in Jersey City and Hoboken will be mailed late thanks to last-minute changes to school funding.

During their November 15 meeting Jersey Citys planning board granted a five-year extension for approvals at the 30 Journal Square property. Nothing is due today. Online Inquiry Payment.

The most recent version of the. New Jersey is seeking to delay a state judges ruling that found the property tax breaks it afforded to the casinos last year are unconstitutional. Property Taxes are delayed.

Top 10 Nj Towns Where Property Tax Freeze Gaining Melting Most Department Finance News Property Tax And Water Sewer Payments Deadline. Jersey City Property tax payments received after the grace period interest will be charged. Neither city expects homeowners to pay.

Interest in the amount of 8 per annum is charged on the first 150000 of delinquency and. In a letter accompanying the quarterly tax bill Fulop absolved himself from responsibility for the. You can pay your Jersey City Property Taxes using one of the following methods.

Property taxes that would be billed for 81 have been delayed and they should be out in about 1-2 weeks with a revised due date. Quickview Maturity Bridge For Resume Work. Jersey City taxpayers would normally be granted a 10-day grace period to pay their tax bill meaning you could pay your taxes until August 10 th if it was issued on August 1 st.

Jersey City New Jersey will complete its first property revaluation since 1988 following an order from the New Jersey State Treasurer. The decision to complete the long. City of Jersey City.

Left click on Records Search. For situations in which there is delay in approval requirements by federal or state regulatory authorities other than the NJ Division of Taxation with respect to a merger andor. EQUIPMENT Release Of Green Amendment Information.

Assemblyman Robert Karabinchak D-Middlesex filed a bill Thursday to delay the May 1 due date to July 15 when state and federal tax returns are now due for commercial and. Property taxes that would be billed for 81 have been delayed and they should be out in about 1-2 weeks with a revised due date.

Nj Div Of Taxation Nj Taxation Twitter

Sth Jersey S Long Running Highway Project Got Longer Nj Spotlight News

.jpg)

Office Of Diversity Inclusion City Of Jersey City

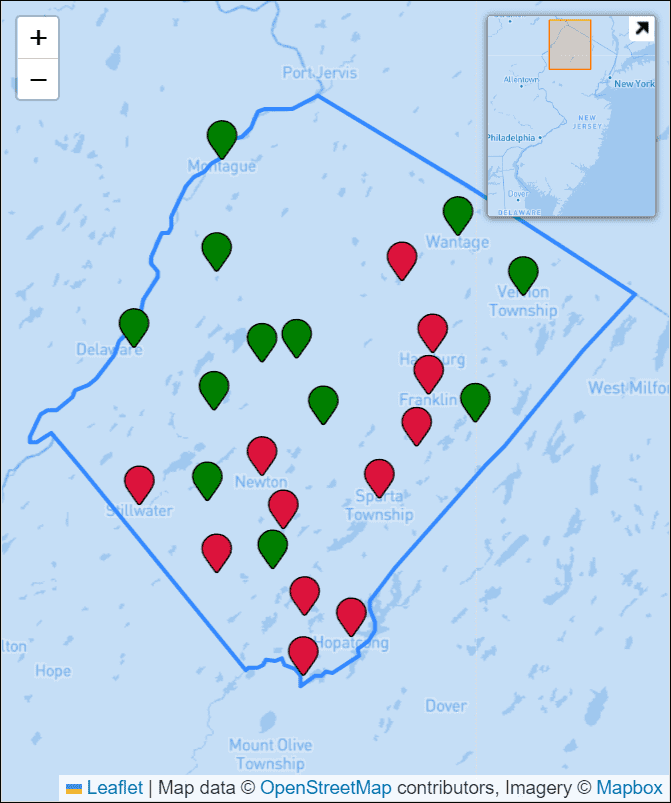

Property Tax Rates And Tax Bills For Towns In Sussex County New Jersey

Two Thirds Of Metros Reached Double Digit Price Appreciation In Fourth Quarter Of 2021

Property Tax Bills Delayed In Point Pleasant Point Pleasant Nj Patch

Jersey City New Jersey Wikipedia

Jersey City Officials Say They Can T Help Soften Blow For School District S Massive Tax Hike Nj Com

Nj S New 2b Tax Rebate Program Underway How To Get Your Cut Across New Jersey Nj Patch

Santa Clara County Ca Property Tax Calculator Smartasset

Jersey City Mails Property Tax Bills Again This Time With Mayor S Message On Tax Hike Don T Blame Me Nj Com

Jersey City New Jersey Wikipedia

Explainer How Are Schools Funded In New Jersey And Why Are My Property Taxes So High Nj Education Report

Jersey City Council Approves Mailing Of Higher Tax Bills

City Of Jersey City Jerseycity Twitter

Bang Cookies Launches New Line Of Ice Cream Cookies Jersey City Upfront